How Hims Stock Leads the Way in the Telehealth Revolution

Estimated reading time: 9 minutes

The telehealth industry has undergone a seismic shift over the past few years, especially in the wake of the COVID-19 pandemic. Among the frontrunners in this transformation is Hims & Hers Health Inc. (NYSE: HIMS), a company that has not only capitalized on the growing demand for virtual healthcare but has also positioned itself as a leader in men’s health and wellness.

This blog post explores how Hims stock is not just a financial instrument, but a key indicator of the evolving telehealth landscape. This post delves into the company’s strategies, impact on healthcare access, and what it means for investors and consumers seeking innovative healthcare solutions.

The Significance of Hims Stock on Telehealth

Hims stock (NYSE: HIMS) represents more than just a financial investment; it embodies the evolution of healthcare delivery. Telehealth refers to the delivery of healthcare services through digital communication technologies, allowing patients to consult with healthcare providers remotely.

As telehealth continues to gain traction, particularly following the COVID-19 pandemic, companies like Hims are at the forefront of this revolution. With its unique business model and focus on men’s health, Hims is well-positioned to capitalize on the burgeoning demand for accessible healthcare solutions.

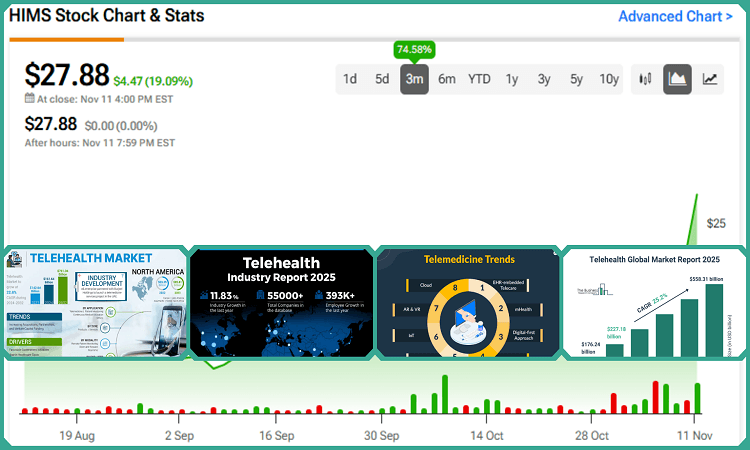

The global telehealth market is projected to reach approximately $759.87 billion by 2030, growing at a compound annual growth rate (CAGR) of 38.70% from 2023 to 2030. This rapid expansion underscores the increasing acceptance of virtual healthcare solutions, driven by technological advancements and changing consumer preferences.

Hims & Hers has emerged as a key player in this space, offering a range of services that cater to men’s health issues, including sexual health, hair loss, and mental health. The company’s innovative approach not only addresses pressing health concerns but also aligns with broader trends in healthcare accessibility and convenience.

Key Concepts and Theories of Hims Stock

To understand Hims’ position in the telehealth landscape, it’s essential to grasp some fundamental concepts:

- Telehealth: This refers to the delivery of healthcare services via digital platforms, allowing patients to access medical advice and treatment without needing to visit a healthcare facility physically.

- Direct-to-Consumer (DTC) Model: Hims operates primarily through a DTC model, which allows it to engage directly with consumers. This approach not only reduces costs but also enhances customer experience by providing tailored health solutions.

- Men’s Health Focus: By targeting often-taboo subjects like erectile dysfunction, hair loss, and mental health issues, Hims has carved out a niche that resonates with its audience.

Key Factors Driving Hims Stock’s Surge

Based on the search results, key factors driving the surge in Hims stock include:

- Positive News and Strategic Moves: Positive news regarding the company’s strategic moves and market expansion plans influence stock trading.

- New Programs: Launching the Health Collective and Community Member Council boosts customer engagement and potentially creates new revenue channels.

- Strong Earnings Results: Hims stocks surged following strong earnings results that exceeded market expectations.

- Revenue Growth: Hims has demonstrated robust revenue growth. In Q3 2024, the company reported a 77% year-over-year increase in sales, surpassing $400 million.

- Analyst Ratings: Positive ratings from analysts, such as BTIG initiating coverage with a “Buy” rating and Needham & Company naming Hims a top pick for 2025, contribute to investor confidence.

- Partnerships: Strategic partnerships, such as the one with Eli Lilly to streamline access to obesity medication Zepbound, can drive growth.

- Innovative Business Model: Hims’s innovative business model and effective pharmacy integration contribute to its growth.

- Investor Optimism: Overall investor optimism in Hims’s business model and growth prospects drives the stock surge.

- Super Bowl Ad: A recent Super Bowl ad promoting its weight loss product led to increased investor sentiment and a significant uptick in web traffic.

Investor Sentiment Roles in Hims Stock’s Surge

Investor sentiment plays a crucial role in the recent surge of Hims & Hers Health Inc. (HIMS) stock, reflecting how market perceptions and expectations can significantly influence stock performance. Here are the key ways investor sentiment has contributed to this surge:

Positive Market Reactions

- Strong Earnings Reports: The anticipation surrounding Hims Stock’s upcoming earnings reports has generated optimism among investors. Positive forecasts and strong financial performance in previous quarters have led to increased confidence in the company’s growth trajectory, prompting investors to buy into the stock.

- Strategic Initiatives: Hims Stock’s recent announcements, such as the launch of the Health Collective and Community Member Council, have been well-received. These initiatives are perceived as efforts to enhance customer engagement and drive growth through user-led programs. Such strategic moves signal to investors that Hims is actively working to innovate and expand its market presence, fostering a positive sentiment.

- Effective Marketing Campaigns: The recent Super Bowl ad promoting Hims Stock’s weight loss product resulted in a significant uptick in web traffic and investor interest. This high-profile marketing effort not only raised brand awareness but also demonstrated the company’s commitment to expanding its product offerings, further boosting investor confidence.

Analyst Ratings and Recommendations

- Analyst Upgrades: Positive ratings from analysts, such as BTIG initiating coverage with a “Buy” rating, have bolstered investor sentiment. Analysts’ endorsements often serve as a signal to investors that a stock is worth considering, leading to increased buying activity and driving up the stock price.

- Consensus on Growth Potential: The consensus among analysts regarding Hims Stock’s growth potential, particularly in the telehealth sector, has contributed to an optimistic outlook. Investors are encouraged by projections of robust revenue growth, especially in emerging health categories like obesity treatment.

Market Trends and Investor Behavior

- Broader Health Sector Trends: The overall bullish sentiment in the health and wellness sector has positively impacted Hims Stock’s performance. As investors seek innovative companies within this rapidly growing market, Hims stands out due to its unique business model and focus on telehealth solutions.

- Speculative Trading: The volatility of Hims stock’s price reflects speculative trading behavior among investors who are eager to capitalize on perceived opportunities for quick gains. This speculative nature can amplify price movements based on news cycles or market trends.

Investor sentiment is a powerful driver behind Hims stock’s surge. Positive reactions to earnings reports, strategic initiatives, effective marketing campaigns, favorable analyst ratings, and broader market trends all contribute to an optimistic outlook for the company. As Hims continues to innovate and expand within the telehealth space, maintaining this positive sentiment will be crucial for sustaining its stock performance moving forward.

Current Trends and Developments

The telehealth market is projected to reach $668.63 billion by 2031, growing at a compound annual growth rate (CAGR) of 24.54%. This rapid growth is fueled by several trends:

- Increased Acceptance of Telehealth: The pandemic accelerated the adoption of telehealth services. Consumers have become more comfortable seeking medical advice online, which has led to a surge in demand for platforms like Hims.

- Technological Advancements: Innovations such as artificial intelligence (AI) and machine learning (ML) are enhancing telehealth services by enabling personalized patient care and improving diagnostic accuracy.

- Focus on Mental Health: There has been a notable increase in demand for mental health services delivered through telehealth platforms. Hims has expanded its offerings to include mental health support, aligning with this growing trend

Case Studies and Examples

Hims Stock’s success can be attributed to its innovative approach and strategic marketing efforts:

- Breaking Stigmas: By normalizing discussions around men’s health issues that are often considered embarrassing, such as erectile dysfunction and hair loss, Hims has successfully engaged millions of men who previously avoided seeking help. This strategy has resulted in approximately 7.5 million monthly visitors to their website.

- User-Centric Design: The platform’s user experience is designed for ease of use. Patients can complete a health assessment online, receive prescriptions from licensed professionals, and have medications shipped discreetly to their homes. This seamless process has contributed significantly to customer satisfaction and retention rates.

- Strong Financial Performance: Recent reports indicate that Hims stock surged by over 12% following strong earnings results that exceeded market expectations. With a gross margin of 81.1% and an EBIT margin of 8.5%, Hims demonstrates solid financial health despite operating in a competitive market

FAQs

What services does Hims offer?

Hims provides a range of telehealth services focused on men’s health issues such as erectile dysfunction, hair loss, anxiety, and other conditions requiring medical attention. Patients can consult with licensed healthcare providers online.

How does Hims ensure patient privacy?

Hims places a high priority on patient confidentiality, employing robust security measures such as encrypted communication channels for online consultations and discreet packaging for all medication deliveries, ensuring privacy throughout the entire process.

Is insurance accepted by Hims?

Currently, Hims does not bill insurance companies directly. Patients utilizing Hims’s services pay out-of-pocket for their consultations and any prescribed medications, handling the financial transactions themselves.

What is the cost structure for using Hims?

The average monthly cost for accessing Hims Stock’s comprehensive services, encompassing both online consultations with healthcare professionals and discreet deliveries of prescribed medications, is approximately $100.

How does Hims differentiate itself from competitors?

Hims stands out by focusing specifically on men’s health issues that are often stigmatized. Their marketing strategies effectively engage customers who may feel uncomfortable discussing these topics in traditional healthcare settings.

In Conclusion

Hims & Hers Health Inc. exemplifies how innovative approaches in telehealth can lead to substantial growth opportunities for investors and improved healthcare access for consumers. As the company continues to expand its offerings and refine its business model, it remains well-positioned within the rapidly evolving telehealth landscape.

Investors looking at Hims stock should consider not only its current performance but also its potential within an industry projected for explosive growth over the next decade. By understanding the trends shaping telehealth and recognizing Hims Stock’s unique position as a leader in men’s health solutions, stakeholders can make informed decisions about their investments in this promising sector.

In summary, as telehealth continues to revolutionize healthcare delivery, Hims stands out as a key player worth watching—both for its innovative approach to men’s health and its robust financial performance amid an expanding market landscape.

![]()

- The Truth About Home Security Systems Everyone Should Know - February 15, 2025

- Best Weight Loss Food Programs: 18 Tips and Tricks for Success - February 15, 2025

- Is Your Google Business Profile Safe? Find Out Now to Fix It - February 15, 2025

Discover more from Akinpedian

Subscribe to get the latest posts sent to your email.